41 risk based bank rating

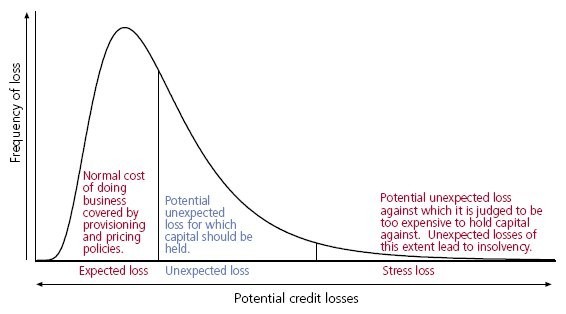

A Risk-Factor Model Foundation for Ratings-Based Bank Capital Rules Michael B. Gordy Board of Governors of the Federal Reserve System October 22, 2002 Abstract When economic capital is calculated using a portfolio model of credit value-at-risk, the marginal capital Risk-based pricing is a method that lenders use to determine interest rates and other loan and credit card terms based on the applicant's creditworthiness. Credit scores are the primary way lenders can evaluate your creditworthiness, but they may also consider other factors.

necessary to adjust Risk-based Bank Rating for. Islamic Commercial Banks and Islamic Business. Units in a Financial Services Authority Regulation;.

Risk based bank rating

Risk 12 |-based bank supervision manual CBK 3. THE RISK BASED SUPERVISORY PROCESS The supervisory process is a full cycle. It is a continuous and dynamic process consisting of the following steps: 1. Understanding the Institution - Understanding the Institution's unique characteristics, corporate culture and risk profile; 2. Ever since 1999 and the tech bubble implosion, Fed-engineered boom/bust cycles have been the most efficacious means for the Wall Street-Federal Reserve Looting Syndicate to transfer the wealth and assets of the increasingly pauperized middle and working classes, i.e. the retail investor muppets, to the Fed's oligarch accomplices. We had the tech bubble bust, the housing bubble bust, and then the 2008 financial crash. Each of these events enabled the already super-wealthy to concentrate even more... Hi guys, I learned about bitcoin last year and it really changed my life. The more I learn about it, the more I am convinced that it is the future, probably the most significant invention in human history. I've been accumulating btc with DCA and plan never to sell. The idea of earning interest is very attractive so I've been using Celcius, blockfi and other Cefi planforms. As everyone knows, the rates haven't been dropping and as a result, the optimizing engineering in me has been chasing hi...

Risk based bank rating. 15 Nov 2021 — The assessment by the method of Risk-Based Bank Rating consists of four factors of risk profile, Good Corporate Governance, earning and capital ... The assessment of stressed assets in the standard book is based on the credit risk profiles of the top exposures, and the rating and sectoral distribution of the loan book. The track record of slippages, provision coverage ratio (PCR), and recovery prospects are also considered. Retail, agriculture and MSME loans 29. Webb Bank has a composite CAMELS rating of 2, a total risk-based capital ratio of 10.2 percent, a Tier 1 risk-based capital ratio of 6.2 percent, a CET1 leverage ratio of 5.0 percent, and a Tier I leverage ratio of 4.8 percent. What deposit insurance risk category does the bank fall into, and assuming the DIF reserve ratio is currently 1.20 percent, what is the bank’s deposit insurance assessment rate? Two depository institutions have composite CAMELS ratings of 1 or 2 and are “well capitali... by M Ponto · 2018 — THE INFLUENCE OF RISK-BASED BANK RATING (RBBR) METHOD ON PROFITABILITY OF PRIVATE-OWNED BANKS IN INDONESIA.

Bank wajib melakukan penilaian Tingkat Kesehatan Bank secara individual dengan menggunakan pendekatan risiko ( Risk-based Bank Rating) sebagaimana dimaksud dalam Pasal 2 ayat (3), dengan cakupan penilaian terhadap faktor-faktor sebagai berikut: a. Profil risiko ( risk profile ); b. Good . . . The bank should have an understanding of the money laundering and terrorist financing risks of its customers, referred to in the rule as the customer risk profile. 3 See 31 CFR 1020.210(b)(5)(i) This concept is also commonly referred to as the customer risk rating. Any customer account may be used for illicit purposes, including money ... Bank Rating Methodology, 2015 Our bank BCAs describe the probability of a bank defaulting on any of its rated instruments, in the absence of external support. There are three stages to the BCA analysis: a 'Macro Profile' reflecting system risks, the Financial Profile, incorporating key metrics, and additional Qualitative Factors. BCA ... Risk-Based Assessments. Effective July 1, 2016, all established insured institutions receive a risk rate scorecard to determine their FDIC assessment base rate. Only new small institutions, as discussed below, receive a Risk Category assignment. * Total base rates that are not the minimum or maximum rate will vary between these rates.

Published 11/11/2021, 5:21am EST https://www.manager-magazin.de/finanzen/geldanlage/evergrande-glaeubiger-dmsa-bereitet-insolvenzantrag-vor-a-8824cc4a-ae06-4eb9-b789-6670bac56eb5 (Translated with Google) Once again, real estate giant Evergrande failed to pay interest on bonds. More than 20 other offshore bonds are therefore considered to have defaulted, says Marco Metzler. The credit analyst prepares a bankruptcy petition against Evergrande for the creditor DMSA. The Chinese real estate... The commercial real estate market is collapsing in China, and foreign lenders are being left in the dark while Chinese borrowers are prioritising domestic lenders. [https://www.reuters.com/world/china/chinese-markets-return-break-more-evergrande-angst-2021-10-07/](https://www.reuters.com/world/china/chinese-markets-return-break-more-evergrande-angst-2021-10-07/) Notable from the article - SHANGHAI/SINGAPORE/HONG KONG, Oct 8 (Reuters) - China Evergrande Group [**(3333.HK)**](https://www.reute... Risk Based Bank Rating September 30: Download: 2019: Risk Based Bank Rating December 31 Download: 2018; Years: Month Report ... 29. Webb Bank has a composite CAMELS rating of 2, a total risk-based capital ratio of 10.2 percent, a Tier 1 risk-based capital ratio of 6.2 percent, a CET1 leverage ratio of 5.0 percent, and a Tier I leverage ratio of 4.8 percent. What deposit insurance risk category does the bank fall into, and assuming the DIF reserve ratio is currently 1.20 percent, what is the bank’s deposit insurance assessment rate? Two depository institutions have composite CAMELS ratings of 1 or 2 and are “well capitali...

Bank Valuation And Value Based Management Deposit And Loan Pricing Performance Evaluation And Risk Management Ebook By Jean Dermine 9780071785785 Rakuten Kobo United States

Risk rating involves the categorization of individual credit facilities based on credit analysis and local market conditions, into a series of graduating categories based on risk. A primary function of a risk rating model is to assist in the underwriting of new loans. As well, risk ratings assist

Composite Ratings. Composite Ratings of 3, 4, or 5 may subject the bank to enforcement actions, enhanced monitoring, and limitations on expansion. Banks with a composite 1 rating generally have components rated 1 or 2. They exhibit the strongest performance and risk-management practices relative to their size, complexity, and risk profile, and ...

Each lender uses its own process to determine the risk that you will default on a loan, but most use your credit score, employment status, income, and other outstanding debts, among other factors. If a lender relied on a credit report in making a lending decision about you, you should get a Risk-Based Pricing notice if you receive less ...

The bank structures its BSA/AML compliance program to address its risk profile, based on the bank's assessment of risks, as well as to comply with BSA regulatory requirements. Specifically, the bank should develop appropriate policies, procedures, and processes to monitor and control its ML/TF and other illicit financial activity risks.

**I am getting increasingly worried about the amount of warning signals that are flashing red for hyperinflation- I believe the process has already begun, as I will lay out in this paper. The first stages of hyperinflation begin slowly, and as this is an exponential process, most people will not grasp the true extent of it until it is too late.** I know I’m going to gloss over a lot of stuff going over this, sorry about this but I need to fit it all into four posts without giving everyone a 400 ...

UB

by E Sistiyarini · 2017 · Cited by 11 — This study aimed to find the influence RBBR (Risk Based Bank Rating) ratio's to predict the bankruptcy of conventional Banks in Indonesia. The ratio of RBBR ...

***TLDR*** *: This is a sum of the most important Universal Basic Income experiments (when you hand over enough cash to people to survive, for free, without any conditions), that shows that it works in alleviating all social issues, poverty, illnesses, unemployment and lack of education, proving to be far more effective than traditional traditional welfare state approaches, with its monstruous bureauratic conundrum, while costing much less money too !* ​ **London, May 2009**...

Hello beautiful apes, I have some things to share with you that I feel we need to internalize as a community. This is not hopium, and it is not FUD. This is somewhere in the middle. Giving a realistic perspective on what's actually going on. And it is important that we grasp the severity of the real situation so no one gets trapped anymore. And the real reason why MOASS is finally upon us. No hype baiting, no calls to action, no dates. Just sharing my perspective with some strong opinions, s...

Bank dengan menggunakan pendekatan risiko (Risk-based Bank Rating) baik secara individu maupun secara konsolidasi. BAB II PENILAIAN TINGKAT KESEHATAN BANK Pasal 3 (1) Bank wajib melakukan penilaian sendiri (self-assessment) atas Tingkat Kesehatan Bank sebagaimana diatur dalam Pasal 2 ayat (3). ...

Lots of companies are trying to expand their market share, especially in the app market, by offering cash or cash-equivalent incentives to new users. If one company offers new users a free stock/cryptocurrency/etc., and a competitor doesn't, then the company with the referral program will gain more market share. This gives you the opportunity generate a nice chunk of change by signing up for a bunch of different apps. I very frequently search the web for the latest and greatest referral opportu...

To start, I’ll give you a small clip of a recent podcast with Vitalik (creator of Ethereum) talking about Zkrollups and how he thinks Loopring is the solution for Ethereum problems of scaling and gas fees (fees from using etherium). https://youtu.be/XW0QZmtbjvs I recommend this bit from 1hr:14:00 to 1hr:17:40 to understand Loopring and ZkRollups from his words. The whole Rollups section is very interesting. The whole video is also very nice for apes with more patience :) Let me explain in...

Review Of Supervisory Processes For Commercial Banks Supervisory Rating V Under The Risk Based Approach Pdf Document

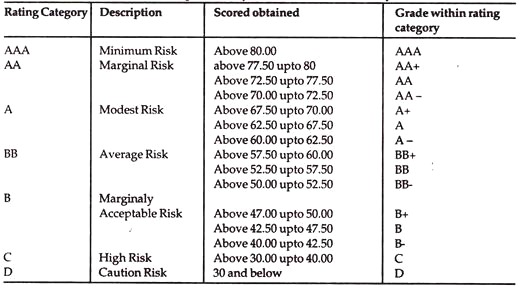

Bank Rating (RBBR) method whether the bank is classified into one of the 5 categories: very healthy, healthy, healthy enough, not healthy enough, and unhealthy. Risk Based Bank Rating (RBBR) method is used to assess the health rating of bank based on 3 factors, i.e. Risk Profile, Earning, and Capital.

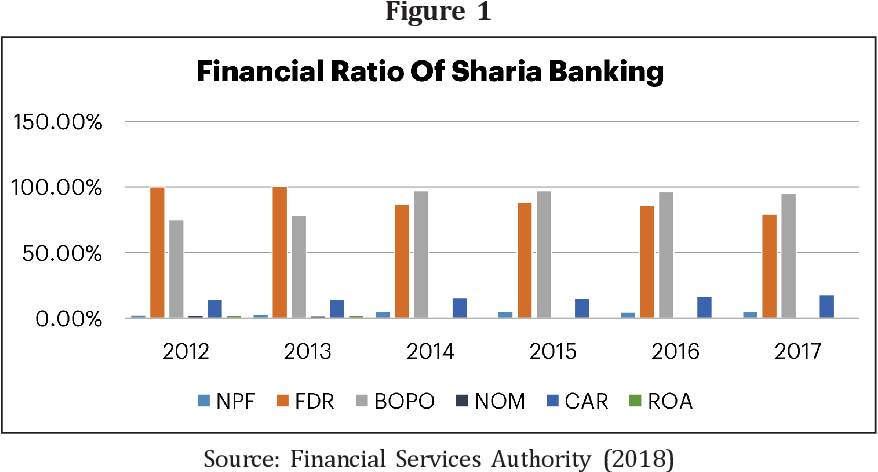

The purpose of this research is to examine the effect of bank soundness as measured by risk based bank rating on stock returns. Risk based bank rating consists of risk profile (credit risk-NPL and liquidity risk-LDR), GCG disclosure, earnings (return on assets-ROA and operating expense to income ratio-OEIR), and capital (CAR).

SR 98-25, ''Sound Credit Risk Management and the Use of Internal Credit Risk Ratings at Large Banking Organizations'' (September 21, 1998), which stresses the importance of risk rating systems for large banks and describes elements of such systems that are ''nec-essary to support sophisticated credit risk management'' (p. 1).

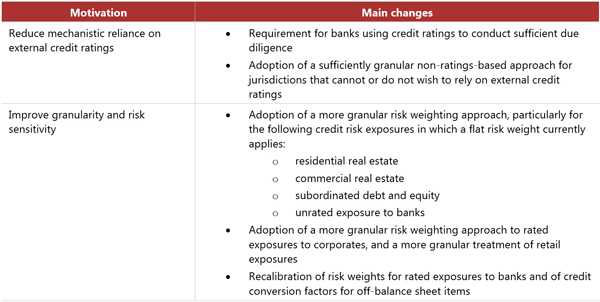

Under the Basel II guidelines, banks are allowed to use their own estimated risk parameters for the purpose of calculating regulatory capital.This is known as the internal ratings-based (IRB) approach to capital requirements for credit risk.Only banks meeting certain minimum conditions, disclosure requirements and approval from their national supervisor are allowed to use this approach in ...

Risk Based Compliance Audit Program Risk Assessment Checklists And Related Requirements Lexisnexis Store

1.2 Definition of Internal Credit Risk Rating System and Internal Credit Risk Rating 1.2.1 Internal Credit Risk Rating System refers to the system to analyze a borrower's repayment ability based on information about a customer's financial condition including its

The frequency of periodic reviews of country risk ratings should be at least once a year with a provision to review the rating of specific country, based on any major events in that country, where bank exposure is high, even before the next periodical review of the ratings is due.

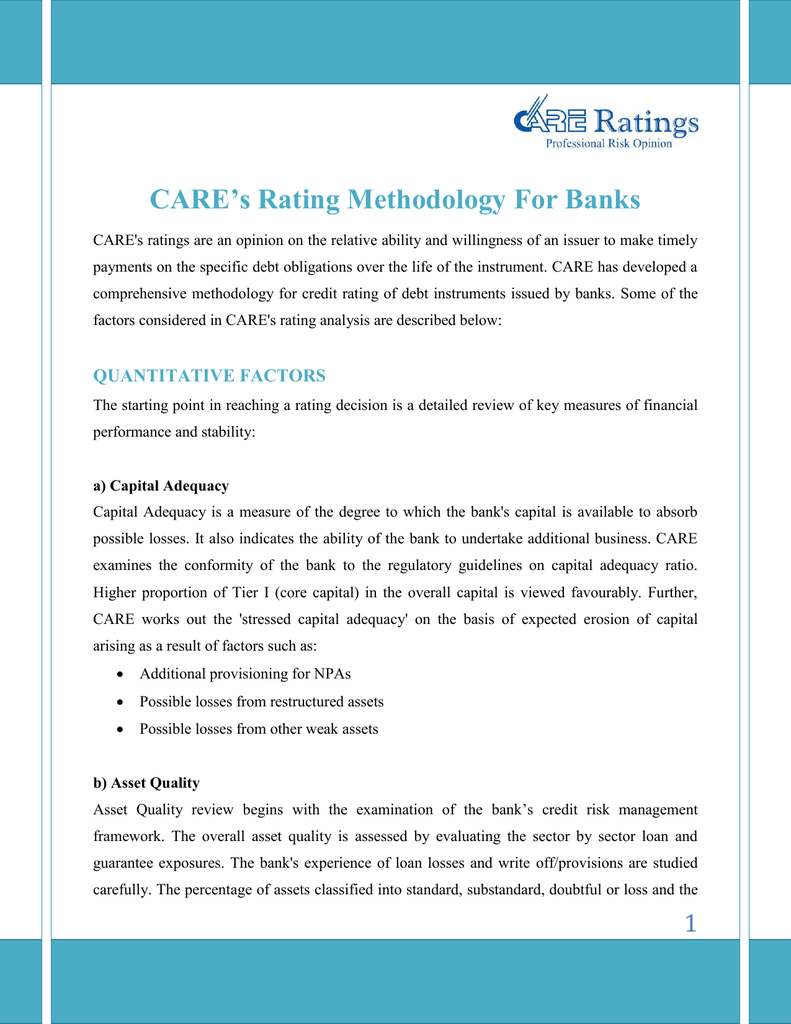

In general, banks are required to maintain a leverage capital ratio of at least 4%, a tier 1 risk-based capital ratio of at least 6% and a total risk-based capital ratio of at least 8%. In addition to the capital ratio, other criteria are used to determine the BauerFinancial™ Star-Rating.

designations are based on a bank's asset size. 6 and factors that affect its risk profile and complexity. When making this designation, the OCC considers, in addition to asset size, whether • the bank and its affiliate charters are part of a much larger banking organization (e.g., under a bank holding company or savings and loan holding ...

**The Yield Bubble, TLT Puts, Inflation and Michael Burry** **“As for my loneliness at the lunch table, it has always been a maxim of mine that while capital raising may be a popularity contest, intelligent investment is quite the opposite. One must therefore take some pride in such a universal lack of appeal." - Michael Burry** The trade I am about to propose is quite unpopular. To screen it’s validity through the market's eyes will only lead to the conclusion of the masses. The conclusion...

Pdf Effect Of Risk Based Bank Rating On Financial Performance Of Sharia Commercial Banks Semantic Scholar

When I say decentralized finance I am specifically talking about removing banks and thus also central banks from the equation which would make it that we theoretically lend to each other with no middle man and no lender of last resort, this would also make it that a central entity wouldn't have control over interest rates and monetary policy. I would like to also state that I don't necessarily think the current banking system is perfect and could do with more regulations and I don't agree or lik...

Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering. The models deployed by most institutions today are based on an assessment of risk factors such as the customer's occupation, salary, and the banking products used.

**Disclaimer:** This exit strategy relies on a bunch of assumptions. The point of this post is not to debate those. If you think this bullrun will last well into 2022 or perhaps even longer, that's cool, you do you. What I'm about to describe is my own exit strategy. I'm not trying to convince you that it's better than your plan, my only hope is that there might be handful of people to whom this makes sense who can take something valuable from this post. As for the rest of you, best of luck, and...

The Key to the "Risk-Based" Principle. To implement the "risk-based" principle, the banking industry needs to shift the focus of AML management from post-analysis and judgment to proactive management. With this in mind, banks must organically integrate risk control ideas, mechanisms, requirements and banks' business development and ...

Gather around folks, hope y’all made some gains the last time around. This DD is split into 8 parts, so feel free to jump to whichever section you’re most interested in. **Part 1 – Introduction** **Part 2 – Market Trends and Upcoming Catalysts** **Part 3 – Company Overview and Unique Value Proposition** **Part 4 – Recent Updates** **Part 5 – Financials and Valuation** **Part 6 – Bear Case** **Part 7 – SI and Squeeze Potential** **Part 8 – TL;DR** **Part 1 – Introduction** It was a warm...

Risk-Based Capital Ratio: Risk Weights at a Glance Final 2015 NCUA Rule. Final FDIC : Comparable to FDIC Risk Weight? Category Sub-Category; ... These are loans above the concentration risk thresholds for credit unions. 10. FDIC identifies certain loans as High Volatility Commercial Real Estate (HVCRE) and assigns a 150% risk weight.

RISK-BASED BANK RATING (RBBR) NAMA : TIA LUTHFIAH NIM : 20130730120 KELAS : EPI - C Berdasarkan Undang-undang Nomor 10 Tahun 1998 tentang Perubahan atas Undang-undang No.7 Tahun 1992 tentang Perbankan, pembinaan dan pengawasan Bank dilakukan oleh Bank Indonesia. Undang-undang tersebut lebih lanjut menetapkan bahwa: a. Bank wajib memelihara tingkat kesehatan Bank (RBBR)…

Risk Based Bank Rating (RBBR) Pada peraturan Bank Indonesia No 13/1/PBI/2011 pasal 2 , disebutkan bank wajib melakukan penilaian tingkat kesehatan bank dengan menggunakan pendekatan risiko (Risk Based Bank Rating) baik secara individual ataupun konsolidasi. Dalam metode ini terdapat beberapa indikator sebagai acuannya, yaitu :

Housekeeping: * HOW TO SUPPORT: I know we are all facing unprecedented financial hardships right now. If you are in the position to support my work, I have a [patreon](https://www.patreon.com/RusticGorilla), [venmo](https://venmo.com/code?user_id=2974196418215936837), and a [paypal](http://paypal.me/CobbAdrienne) set up. No pressure though, I will keep posting these pieces publicly no matter what - paywalls suck. * NOTIFICATIONS: You can [signup](http://eepurl.com/gKUtUH) to receive a once-we...

Webb Bank Has A Composite Camels Rating Of 2 A Total Risk Based Capital Ratio Of102 Percent A Tier 1 Risk Based Capital Ratio Of 52 Percent And A Course Hero

There have been several recent threads with variations on this topic with lots of good discussion. I thought I would create a centralized thread with some of the most common questions I’ve seen, as well as a brief overview of the asset. **What are I Series Bonds?** Series I Bonds (or I-Bonds) are U.S. Treasury issued savings bonds, not so different from the ones you used to get from Grandma every year (which were EE series bonds). I-Bonds were created in 1998 to give the average American a w...

by D Munawaroh · 2019 · Cited by 4 — Risk Based Bank Rating (RBBR) is one of the assessments of the new health level of the bank in lieu of CAMELS in accordance in Bank Indonesia Regulation No.

Hi guys, I learned about bitcoin last year and it really changed my life. The more I learn about it, the more I am convinced that it is the future, probably the most significant invention in human history. I've been accumulating btc with DCA and plan never to sell. The idea of earning interest is very attractive so I've been using Celcius, blockfi and other Cefi planforms. As everyone knows, the rates haven't been dropping and as a result, the optimizing engineering in me has been chasing hi...

Ever since 1999 and the tech bubble implosion, Fed-engineered boom/bust cycles have been the most efficacious means for the Wall Street-Federal Reserve Looting Syndicate to transfer the wealth and assets of the increasingly pauperized middle and working classes, i.e. the retail investor muppets, to the Fed's oligarch accomplices. We had the tech bubble bust, the housing bubble bust, and then the 2008 financial crash. Each of these events enabled the already super-wealthy to concentrate even more...

Risk 12 |-based bank supervision manual CBK 3. THE RISK BASED SUPERVISORY PROCESS The supervisory process is a full cycle. It is a continuous and dynamic process consisting of the following steps: 1. Understanding the Institution - Understanding the Institution's unique characteristics, corporate culture and risk profile; 2.

/dotdash_Final_Tier_1_Leverage_Ratio_Definition_Nov_2020-01-4741405e9a8f49b79939f1a51fc3de54.jpg)

/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)

0 Response to "41 risk based bank rating"

Post a Comment